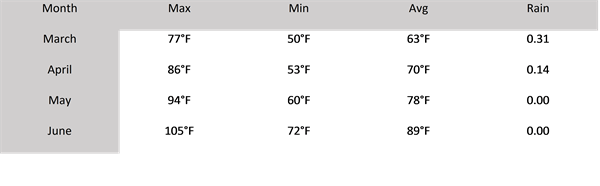

Mar 22, 2023

Fertilizer Resources

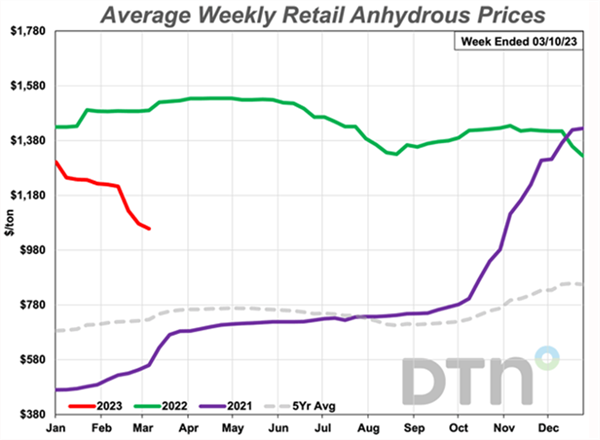

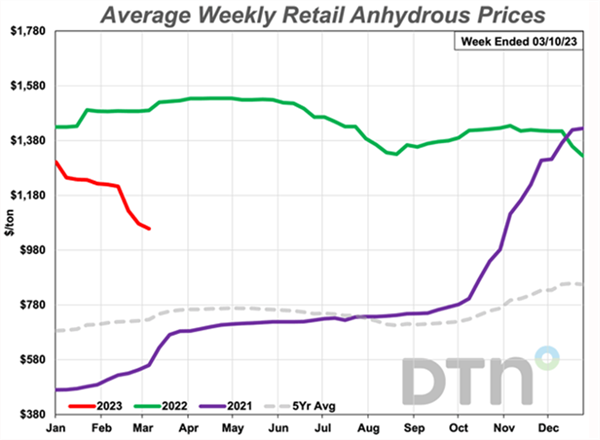

This time last year we were experiencing extremely high fertilizer prices that were continually rising. Fertilizer prices had been steadily increasing throughout 2021 and then experienced an acceleration after the Russian invasion of Ukraine in February 2022. Throughout the desert Southwest and across the nation, high prices have continued for fertilizers used in crop production agriculture over the past year. Now in early 2023 fertilizer prices are starting to decline but are still relatively high compared to prices two years ago. These patterns are shown in Figure 1.

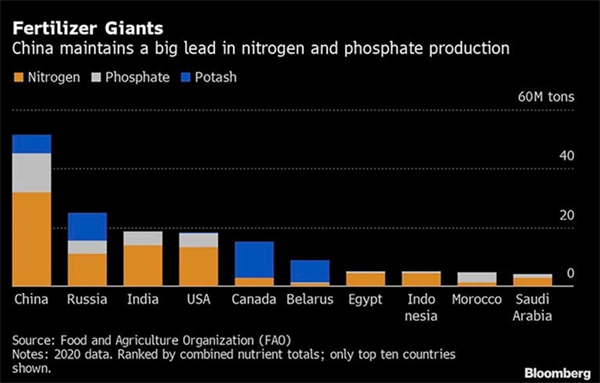

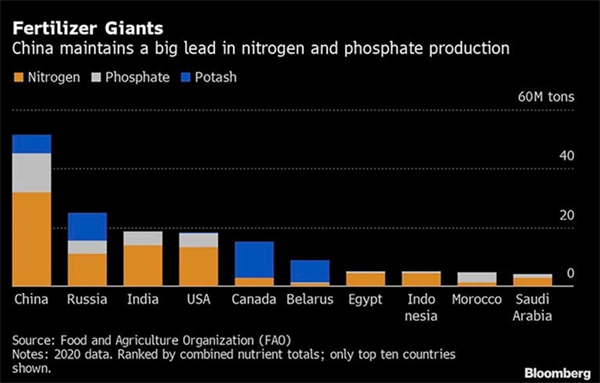

There are at least four important lessons or messages from these recent experiences with global fertilizer prices and the impacts at the field level in crop production systems. First, many people have come to recognize that among global nitrogen (N), phosphorus (P), and potassium (K) fertilizer producers China, Russia, and Belarus are major players and are consistently in the top 10 (Figure 2). Our awareness has been heightened in response to the diminished supply available to U.S. markets from these three nations in the past year. The U.S. ranks fourth in overall N, P, and K fertilizer production.

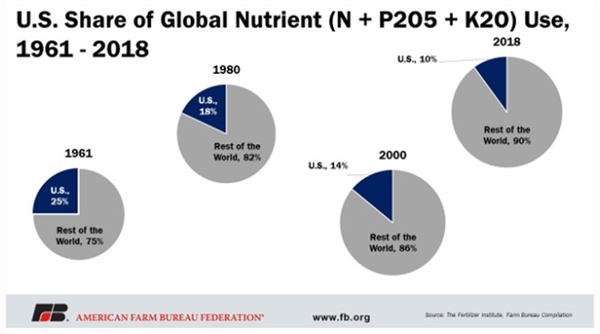

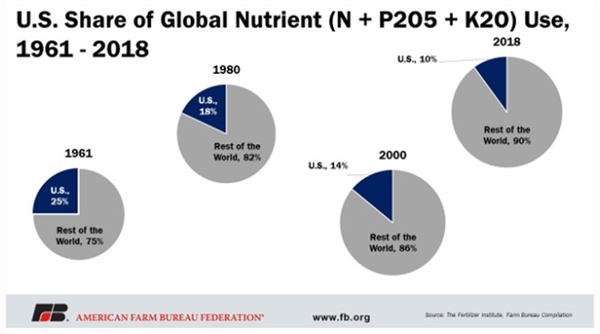

Secondly, as fertilizer use has increased in many parts of the world in the past 60 years, the U.S. now represents only 10% share of the global use of N, P, and K fertilizers (Figure 3).

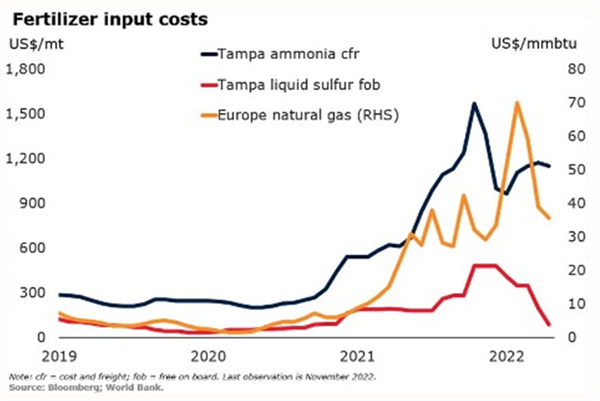

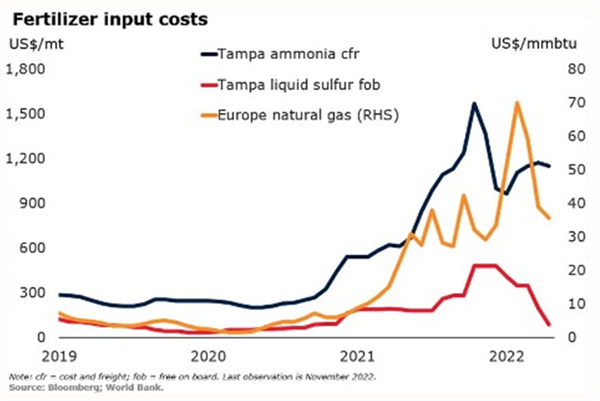

The third point that has been emphasized and has become increasingly clear to the crop production industry, is the connection between fertilizer production input costs, particularly natural gas, and fertilizer prices (Figure 4). Fertilizer production facilities require a large amount of energy to convert the raw chemical materials into their applicable farm-use state. This is very important in terms of N fertilizers.

Regarding prospects for global fertilizers, experts in the industry have the common variance in points of view but there seems to be a general agreement that higher prices have been a function of reduced supply and that was further exacerbated by the Russia-Ukraine war, the loss of a major port for Belarus potash fertilizer, and the P fertilizer supply constraints from China (Baffes and Koh, 2023).

These pressures are not going away soon, but the impacts have diminished in recent months. The constraints on supplies of P and K fertilizers are expected to continue for quite some time into the future. Price reductions have been most notable for N fertilizers, primarily due to lower natural gas prices in Europe compared to 2022.

Crop Nutrient Management

The fourth point of emphasis regarding fertilizer prices and desert crop production systems has been the shift towards more conservative management of fertilizers in the field.

Developing a conservative approach to nutrient management is often considered a risky venture in crop production systems, particularly with a short season crop like a leafy green vegetable that has a premium on quality as well as yield. However, under high fertilizer price conditions and/or tight supply, there is a greater incentive to develop and employ a more conservative approach to nutrient management.

To maximize nutrient management efficiency, the 4R concept of plant nutrient management and application can be helpful. The 4R concept consists of applying:

1. The Right fertilizer source at the

2. Right rate, at the

3. Right time and in the

4. Right place

Along with the 4R nutrient management approach, an assessment of plant-available forms of the nutrients present in the soil by evaluating soil tests with appropriate indices is a good step in the development of a more efficient nutrient management program. Then splitting nutrient applications, particularly mobile nutrients such as N in line with crop uptake and utilization patterns are good steps towards higher fertilizer use efficiency by the crop. Thus, timing, methods, and rates of nutrient applications are critical (i.e., 4R management).

In agriculture we know quite well that we have no control over markets and the costs of crop production inputs. However, we can control these inputs in the field, and we do have some tools at our disposal that can be helpful in the process.

References:

Baffes, J, W. C. Koh. 2023. Fertilizer prices ease but affordability and availability issues linger. 5 January 2023, World Bank. https://blogs.worldbank.org/opendata/fertilizer-prices-ease-affordability-and-availability-issues-linger

Crawford, A, F. Jomo, E. Elkin, and M. Bristow. 2023. World’s fertilizer market in turmoil. Bloomberg, Farm Progress, 20 February 2023. https://www.farmprogress.com/crops/world-s-fertilizer-market-in-turmoil

Quinn, R. 2023. DTN retail fertilizer trends. DTN Progressive Farmer, 15 March 2023.

https://www.dtnpf.com/agriculture/web/ag/crops/article/2023/03/15/anhydrous-uan-move-even-lower?referrer=NLSnapshot

Figure 1. Average weekly retail prices for anhydrous ammonia (82% N), for

2021, 2022, and through 10 March 2023. Source: DTN/Quinn, 2023.

Figure 2. Ranked nitrogen, phosphorus, and potassium fertilizer production by

country. (FAO and Bloomberg graphics). Crawford et al., 2023.

Figure 3. Pattern of U.S. share in the global nutrient market since

1961. Source: Farm Bureau.

Figure 4. Fertilizer input cost trends, 2019-2022. Source: Bloomberg; World

Bank. Baffes and Koh, 2023.

To contact Jeff Silvertooth go to:

silver@ag.arizona.edu

To contact John Palumbo go to: jpalumbo@ag.Arizona.edu

To contact John Palumbo go to: jpalumbo@ag.Arizona.edu