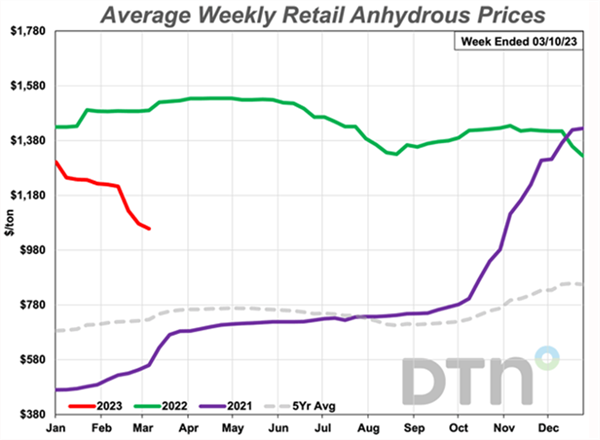

This time last year we were experiencing extremely high fertilizer prices that were continually rising. Fertilizer prices had been steadily increasing throughout 2021 and then experienced an acceleration after the Russian invasion of Ukraine in February 2022. Throughout the desert Southwest and across the nation, high prices have continued for fertilizers used in crop production agriculture over the past year. Now in early 2023 fertilizer prices are starting to decline but are still relatively high compared to prices two years ago. These patterns are shown in Figure 1.

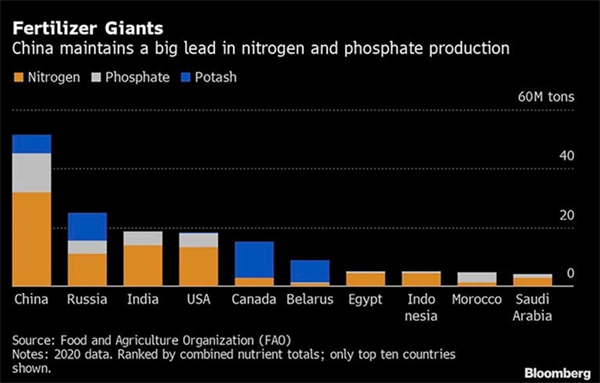

There are at least four important lessons or messages from these recent experiences with global fertilizer prices and the impacts at the field level in crop production systems. First, many people have come to recognize that among global nitrogen (N), phosphorus (P), and potassium (K) fertilizer producers China, Russia, and Belarus are major players and are consistently in the top 10 (Figure 2). Our awareness has been heightened in response to the diminished supply available to U.S. markets from these three nations in the past year. The U.S. ranks fourth in overall N, P, and K fertilizer production.

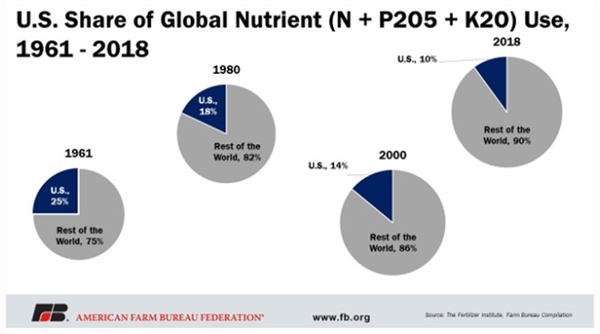

Secondly, as fertilizer use has increased in many parts of the world in the past 60 years, the U.S. now represents only 10% share of the global use of N, P, and K fertilizers (Figure 3).

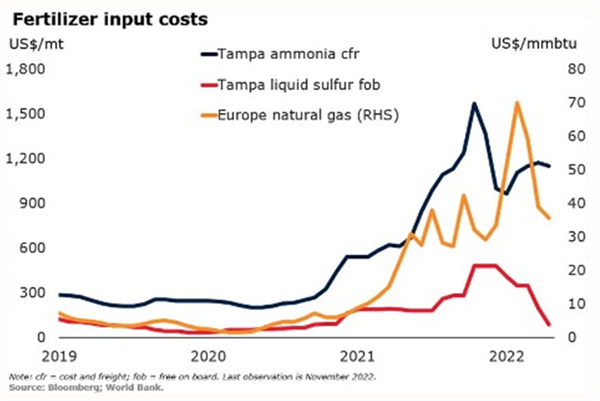

The third point that has been emphasized and has become increasingly clear to the crop production industry, is the connection between fertilizer production input costs, particularly natural gas, and fertilizer prices (Figure 4). Fertilizer production facilities require a large amount of energy to convert the raw chemical materials into their applicable farm-use state. This is very important in terms of N fertilizers.

Regarding prospects for global fertilizers, experts in the industry have the common variance in points of view but there seems to be a general agreement that higher prices have been a function of reduced supply and that was further exacerbated by the Russia-Ukraine war, the loss of a major port for Belarus potash fertilizer, and the P fertilizer supply constraints from China (Baffes and Koh, 2023).

These pressures are not going away soon, but the impacts have diminished in recent months. The constraints on supplies of P and K fertilizers are expected to continue for quite some time into the future. Price reductions have been most notable for N fertilizers, primarily due to lower natural gas prices in Europe compared to 2022.

Crop Nutrient Management

The fourth point of emphasis regarding fertilizer prices and desert crop production systems has been the shift towards more conservative management of fertilizers in the field.

Developing a conservative approach to nutrient management is often considered a risky venture in crop production systems, particularly with a short season crop like a leafy green vegetable that has a premium on quality as well as yield. However, under high fertilizer price conditions and/or tight supply, there is a greater incentive to develop and employ a more conservative approach to nutrient management.

To maximize nutrient management efficiency, the 4R concept of plant nutrient management and application can be helpful. The 4R concept consists of applying:

1. The Right fertilizer source at the

2. Right rate, at the

3. Right time and in the

4. Right place

Along with the 4R nutrient management approach, an assessment of plant-available forms of the nutrients present in the soil by evaluating soil tests with appropriate indices is a good step in the development of a more efficient nutrient management program. Then splitting nutrient applications, particularly mobile nutrients such as N in line with crop uptake and utilization patterns are good steps towards higher fertilizer use efficiency by the crop. Thus, timing, methods, and rates of nutrient applications are critical (i.e., 4R management).

In agriculture we know quite well that we have no control over markets and the costs of crop production inputs. However, we can control these inputs in the field, and we do have some tools at our disposal that can be helpful in the process.

References:

Baffes, J, W. C. Koh. 2023. Fertilizer prices ease but affordability and availability issues linger. 5 January 2023, World Bank. https://blogs.worldbank.org/opendata/fertilizer-prices-ease-affordability-and-availability-issues-linger

Crawford, A, F. Jomo, E. Elkin, and M. Bristow. 2023. World’s fertilizer market in turmoil. Bloomberg, Farm Progress, 20 February 2023. https://www.farmprogress.com/crops/world-s-fertilizer-market-in-turmoil

Quinn, R. 2023. DTN retail fertilizer trends. DTN Progressive Farmer, 15 March 2023.

https://www.dtnpf.com/agriculture/web/ag/crops/article/2023/03/15/anhydrous-uan-move-even-lower?referrer=NLSnapshot

Figure 1. Average weekly retail prices for anhydrous ammonia (82% N), for

2021, 2022, and through 10 March 2023. Source: DTN/Quinn, 2023.

Figure 2. Ranked nitrogen, phosphorus, and potassium fertilizer production by

country. (FAO and Bloomberg graphics). Crawford et al., 2023.

Figure 3. Pattern of U.S. share in the global nutrient market since

1961. Source: Farm Bureau.

Figure 4. Fertilizer input cost trends, 2019-2022. Source: Bloomberg; World

Bank. Baffes and Koh, 2023.

This study was conducted at the Yuma Valley Agricultural Center. The soil was a silty clay loam (7-56-37 sand-silt-clay, pH 7.2, O.M. 0.7%). Spinach ‘Meerkat’ was seeded, then sprinkler-irrigated to germinate seed Jan 13, 2025 on beds with 84 in. between bed centers and containing 30 lines of seed per bed. All irrigation water was supplied by sprinkler irrigation. Treatments were replicated four times in a randomized complete block design. Replicate plots consisted of 15 ft lengths of bed separated by 3 ft lengths of nontreated bed. Treatments were applied with a CO2 backpack sprayer that delivered 50 gal/acre at 40 psi to flat-fan nozzles.

Downy mildew (caused by Peronospora farinosa f. sp. spinaciae)was first observed in plots on Mar 5 and final reading was taken on March 6 and March 7, 2025. Spray date for each treatments are listed in excel file with the results.

Disease severity was recorded by determining the percentage of infected leaves present within three 1-ft2areas within each of the four replicate plots per treatment. The number of spinach leaves in a 1-ft2area of bed was approximately 144. The percentage were then changed to 1-10scale, with 1 being 10% infection and 10 being 100% infection.

The data (found in the accompanying Excel file) illustrate the degree of disease reduction obtained by applications of the various tested fungicides. Products that provided most effective control against the disease include Orondis ultra, Zampro, Stargus, Cevya, Eject .Please see table for other treatments with significant disease suppression/control. No phytotoxicity was observed in any of the treatments in this trial.

Interested in the latest developments in automated weeding machines? There are a couple of opportunities at the upcoming 2023 Southwest Ag Summit to stay up to date. The first is the “Innovations in Weed Control Technologies” breakout session where university experts and cutting-edge innovators will provide updates on the latest advances in high precision smart spot sprayers, autonomous ag robots and towed automated weeders (agenda below). The session will be held Thursday, February 23rd from 9:30-11:30 am at Arizona Western College (AWC) in Yuma, AZ. The other is the Southwest Ag Summit Field Demo on February 22nd, where several of these technologies and other state-of-the-art automated weeders will be demonstrated operating in the field. The Field Demos will also be held at AWC and begin at 10:30 am.

For more information about the Southwest Ag Summit, visit https://yumafreshveg.com/southwest-ag-summit/. Please note that at the time of this writing, the website has some incorrect dates and programming information. It will be updated soon, so please check back for accurate information. The flyer below has the correct dates (Fig. 2).

Fig. 1. Agenda for the “Innovations in Weed Control Technologies” educational

session at the 2023 Southwest Ag Summit. Session will be held Thursday,

February 23th at Arizona Western College, Yuma, AZ.

Fig. 2. 2023 Southwest Ag Summit flyer. Event will be held at Arizona

Western College in Yuma, AZ.

Results of pheromone and sticky trap catches can be viewed here.

Corn earworm: CEW moth counts down in all traps over the last month; about average for December.

Beet armyworm: Moth trap counts decreased in all areas in the last 2 weeks but appear to remain active in some areas, and average for this time of the year.

Cabbage looper: Moths increased in the past 2 weeks, and average for this time of the season.

Diamondback moth: Adults increased in several locations last, particularly in the Yuma Valley most traps. Below average for December.

Whitefly: Adult movement remains low in all areas, consistent with previous years

Thrips: Thrips adult movement continues to decline, overall activity below average for December.

Aphids: Winged aphids still actively moving but declined movement in the last 2 weeks. About average for December.

Leafminers: Adult activity down in most locations, below average for this time of season.