I have recently provided some articles for this newsletter addressing the increasing fertilizer prices that U.S. agricultural communities have been experiencing (1 December 2021 and 8 February 2022). The situation continues to change following the Russian invasion of Ukraine, which is making things even more difficult and driving fertilizer prices even higher.

Fertilizer prices have more than doubled in the past year for most materials commonly used in production agriculture. Fertilizer prices have been increasing primarily as a function of higher natural gas prices, high global demand, and low inventories. In addition, supply chain disruptions have served to further complicate the situation. In response, the USDA has announced plans for a $250M investment to support innovative American-made fertilizer to give US farmers more choices in the marketplace (USDA Press Release No. 0060.22). That will be an interesting program to watch.

Now, with the war in Ukraine, the resultant sanctions, and global disruptions; the Russian government has restricted fertilizer exports. This is a major problem since Russia is a major low-cost exporter of every type of crop nutrient, particularly of nitrogen (N), phosphorus (P), and potassium (K). Russia is the second-largest producer of ammonia, urea, and potash and it is the fifth-largest producer of processed phosphates. Russia provides 23% of the global ammonia for the export market, 14% of urea, 21% for potash, and 10% of the processed phosphates (The Fertilizer Institute; TFI, https://www.tfi.org/).

Currently, Belarus and Russia account for about 15% of all world fertilizer. Europe, including Ukraine, are heavily dependent on both countries for fertilizer inputs. Due to Russia’s large fertilizer production and footprint as a global fertilizer supplier, Russian products being removed from the global marketplace will have an impact on supply.

Large amounts of natural gas are required in the industrial process of N fixation by the Haber-Bosch process that provides the base for most N fertilizers. Russia supplies about one-third of Europe's natural gas supply and many of the globally important N fertilizer plants are in Europe.

Potassium fertilizers are mined from deposits of potassium chloride (KCl, muriate of potash), potassium sulfate (K2SO4), and potassium nitrate (KNO3). Canada is by far the largest producer of K fertilizer worldwide. Russia also has huge deposits of K minerals that are mined for fertilizer production and it ranks second in production and #3 globally in K fertilizer exports (Table 1). In 2020, the U.S. was just below Spain and produced ~ 350,000 metric tons of K fertilizer (The Fertilizer Institute; TFI, https://www.tfi.org/; Potash Investing News, https://investingnews.com/daily/resource-investing/agriculture-investing/potash-investing/top-potash-countries-by-production/).

|

Nation |

Metric Tons of K fertilizer |

|

Canada |

14M |

|

Russia |

7.6M |

|

Belarus |

7.3M |

|

China |

5M |

|

Germany |

3M |

|

Israel |

2M |

|

Jordan |

1.5M |

|

Chile |

900K |

|

Spain |

470K |

Table 1. Top countries in K fertilizer production, 2020. U.S. Geological Survey

It’s unfortunately a very great season to be a plant pathologist…

We have confirmed the first sample of Fusarium wilt on lettuce submitted to the Yuma Plant Health Clinic from Yuma County. The stunted seedlings looked like any other typical case of damping-off at the seedling stage. When plated on culture media, subsequently confirmed Fusarium colonies grew abundantly from the declining plant tissues. If you’re not already on guard and scouting, this is a warning that Fusarium is active in Yuma County.

Adding on to this early alert, we’ve received a surge of submissions of young brassicas to the clinic. Several severely wilted and declining plants from around Yuma County have cultured positive for Pythium, likely as an opportunistic invader coming in on the back of all the early-season rain that brought stress to seeds and young transplants. Growers may want to consider oomycides, but only if the seedling disease is first confirmed to be Pythium. Remember, many seedling diseases caused by true fungi are indistinguishable from those caused by Pythium.

If you have any concerns regarding the health of your plants/crops please consider submitting samples to the Yuma Plant Health Clinic for diagnostic service or booking a field visit with me:

Chris Detranaltes

Cooperative Extension – Yuma County

Email: cdetranaltes@arizona.edu

Cell: 602-689-7328

6425 W 8th St Yuma, Arizona 85364 – Room 109

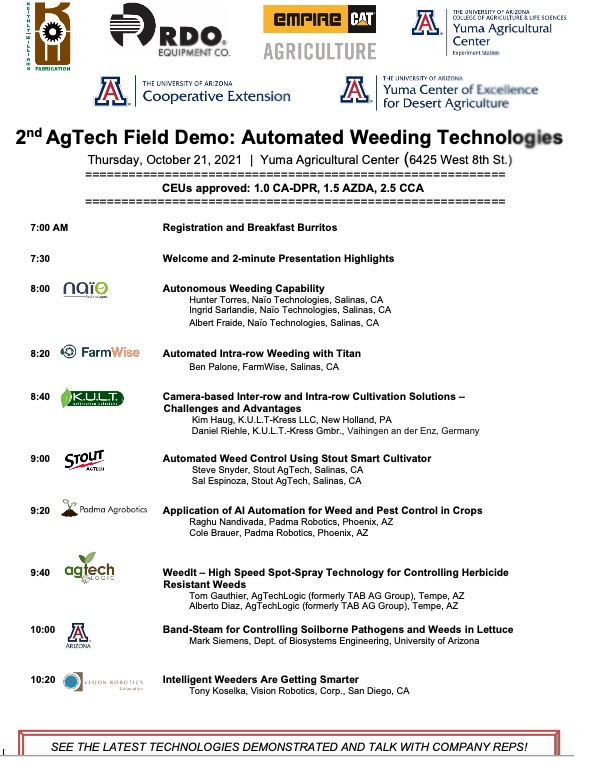

The 2nd AgTech Field Demo: Automated Weeding Technologies will be taking place TOMORROW, October 21st at the Yuma Agricultural Center. Eight of the latest weed control technologies ranging from autonomous in-row weeding machines, to “smart” cultivators to smart spot sprayers to band-steam applicators will be demonstrated in the field. Registration begins at 7:00 am and the program starts at 7:30 am. CEU credits – 1.0 CA, 1.5 AZ and 2.5 CCA are available. Looking forward to seeing everyone there!

Click here forAgenda or see below.

Weeds are a problem year after year even where they have been diligently controlled. A major reason for this is that weed seeds continually move into fields by irrigation water, wind, equipment, contaminated seed and other means. Controlling weeds on irrigation ditch banks can greatly help to reduce weed seed movement into fields.

The EPA regards non-crop areas as those that are not dedicated to crop production. Although crops are not normally grown on irrigation ditch banks, these areas should not be managed as non-crop. Several very broad spectrum and long lasting herbicides are registered for non-crop areas which include roadsides, industrial sites, fence rows, around structures, railroads etc.. Irrigation ditch banks should be considered separately because of their proximity to crop fields and irrigation water and the potential for herbicide movement into sensitive areas.

It is important to read the label carefully and only use those products that are specifically allowed for use on ditch banks. Some products are restricted to drainage ditch banks or dry ditches. Some can be used only above the water line and some can only be used for non-irrigation ditch banks Because most ditches here are used for irrigation, this can be confusing. The definition of a ditch however, can include an open trench or natural channel. It can also include ditches that are not in use for long periods of time. Some labels specify how long this non-use period should be. Some herbicides that have been used on ditch banks in the past are now restricted from this use because of groundwater contamination or off target movement that has occasionally occurred. Do not assume that products that were used for ditch banks in the past can still be used. Even very old products like MSMA can no longer be used for irrigation or drainage ditches. The following summarizes how some of the more common products that have been used on ditches can be used although the product labels should be read for more complete directions. There are several broad spectrum herbicides that are registered for “Non-Crop” sites but that are retricted from use on irrigation ditches. These include Bromacil,Triclopyr,Imazapyr,Thiazapyr Flumioxyzin,Imazomox,Topamezone,Valpar and others.

This time of year, John would often highlight Lepidopteran pests in the field and remind us of the importance of rotating insecticide modes of action. With worm pressure present in local crops, it’s a good time to revisit resistance management practices and ensure we’re protecting the effectiveness of these tools for seasons to come. For detailed guidelines, see Insecticide Resistance Management for Beet Armyworm, Cabbage Looper, and Diamondback Moth in Desert Produce Crops .

VegIPM Update Vol. 16, Num. 20

Oct. 1, 2025

Results of pheromone and sticky trap catches below!!

Corn earworm: CEW moth counts declined across all traps from last collection; average for this time of year.

Beet armyworm: BAW moth increased over the last two weeks; below average for this early produce season.

Cabbage looper: Cabbage looper counts increased in the last two collections; below average for mid-late September.

Diamondback moth: a few DBM moths were caught in the traps; consistent with previous years.

Whitefly: Adult movement decreased in most locations over the last two weeks, about average for this time of year.

Thrips: Thrips adult activity increased over the last two collections, typical for late September.

Aphids: Aphid movement absent so far; anticipate activity to pick up when winds begin blowing from N-NW.

Leafminers: Adult activity increased over the last two weeks, about average for this time of year.